Written by David M. Herszenhorn Posted by Stefanie Marty

It may feel endless, but the health care debate in many ways is just getting started – the various bills are nearly ready, and full debate in the House and Senate lies just ahead. And yet, according to the latest New York Times/CBS News Poll, 6 out of 10 people in the United States are confused about the plans to overhaul the health system.

Nearly half say they don’t know enough about the plans to have an opinion. And one-third can’t fathom a guess as to whether, if the proposed changes are adopted, the system would be better or worse in the years ahead.

So here’s a quick refresher of some of the basic parameters in the health care debate. Please pay attention, there will be a quiz – another poll – and if 59 percent of you are still confused, somebody ought to get fired. Maybe me.

Let’s start with two overarching issues: About 46 million people in the United States do not have health insurance. And health care costs – doctor visits, medicine, hospital care, lab tests, etc. – are rising way too fast. The proposals by President Obama and Congress try to tackle both problems.

First: The Insurance

To cover the uninsured, the government would do two main things:

- Increase the number of people on Medicaid, the federal-state insurance program for the lowest-income Americans.

- Give subsidies to help moderate-income people buy insurance.

To make sure insurance is obtainable, there would be new rules, such as barring insurers from denying coverage based on pre-existing medical conditions.

With a few exceptions, the majority of Americans who already have insurance through an employer — about 160 million people — would have to stay with that coverage.

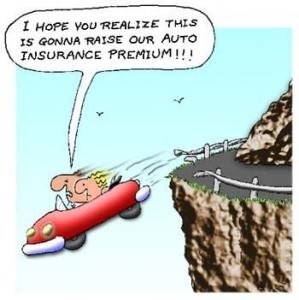

And starting in 2013, nearly everybody would be required to obtain health coverage, or pay a penalty for not doing so. The logic is the same as in requiring auto insurance: anyone without coverage poses a risk of high costs for everyone else. But the proposed “mandate” is also a political flashpoint: Americans tend not to like being told what to do by their government, and Republicans are attacking the penalty as a “tax.”